Paper and White Paperboard Business

FY2023 in review

In FY2023, which was the first year of Medium-term

Management Plan 2026, we pushed our sales activities

in four departments: the Paper Sales Department, the

White Paperboard Sales Department, the Product Logistics

Department, and the International Export Department. Through

communication with various customers, we adapted our sales

strategies for demand changes.

Significant yen depreciation has caused a sharp increase in raw materials and fuel prices, as well as pushing up logistics costs.

As a result, we have made some adjustments to our product

lineup. Meanwhile, we have been facing a noticeable decline in

demand for graphic paper, which is our core product in the fine

paper business. In addition, we have actively communicated

our environmental initiatives to our customers, emphasizing

the superior environmental performance of our products and

promoting the development of environmentally friendly products.

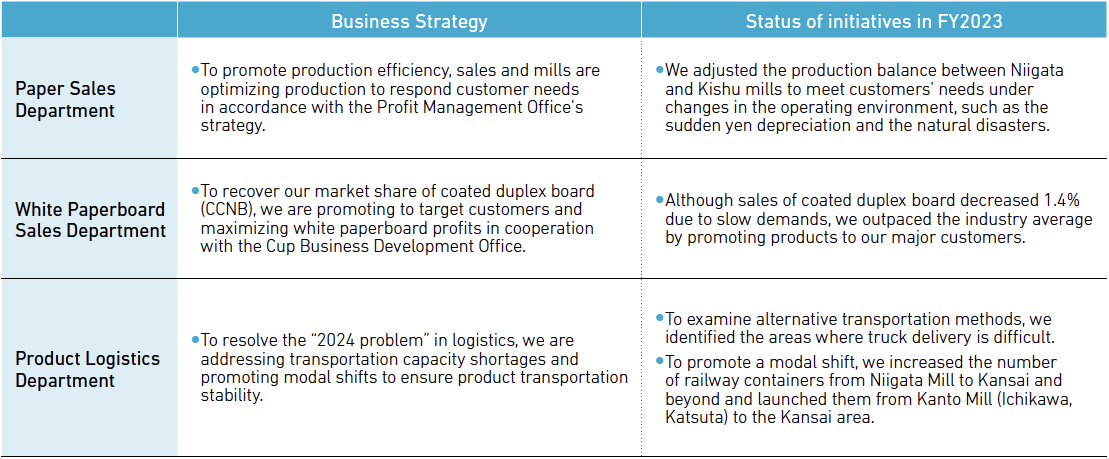

Summary of the Domestic Paper and White Paperboard Sales Division

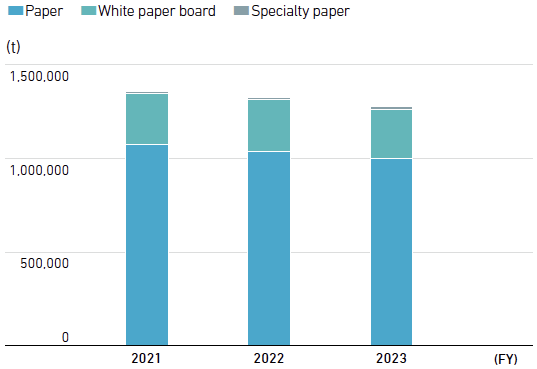

■ Paper and White Paperboard Business: Production

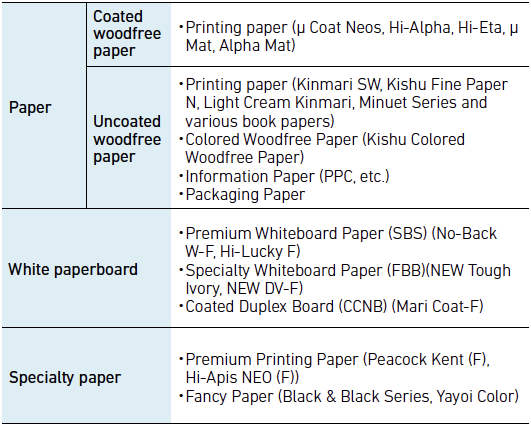

■ Major products (brands)

Business strategy going forward

In April 2024, the start of the second year of Medium-term

Management Plan 2026, we introduced a new organizational

structure with the establishment of the Domestic Paper & White

Paperboard Sales Division and the Global Trading Division.

We also made a clear delineation between the domestic sales

department and the international export department.

The Domestic Paper & White Paperboard Sales Division

aims to secure our market share in the Japanese market

even amid its challenging conditions, taking into account

the price adjustments in FY2022 on both paper and white

paperboard. We will strive to maximize profitability through

production and sales strategies that adapt to changes.

Paper Sales Department

We will maintain our existing customer share and build new

sales channels by highlighting our environmental advantages

and proposing paper solutions with an accurate understanding

of the highly volatile market. We also establish a flexible

production system utilizing our main mills, the Niigata and

Kishu mills. With the Profit Management Office, we aim for

maximum profitability through optimized production.

In coated paper, we will maintain sales volume by

implementing an order-taking system that remains closely aligned with the market and by producing and shipping

products to users in a timely manner.

In uncoated paper, we will secure a market share by making

targeted approaches to various customers and by managing

inventories to minimize the loss of sales opportunities. For our

premium Color Woodfree paper, celebrating the 70th year of

sales in FY2024, we will focus on stimulating demand through

promotional items and strengthening our dealer relationships.

White Paperboard Sales Department

We will recover and further expand sales volumes in various

categories, including high-end white paperboard, specialty

white paperboard, and coated duplex board, by promoting

target users. We will ascertain customers’ needs and work

closely with our mills and Product Logistics Department to

consistently deliver better products to our customers.

In addition, we aim to expand our sales by developing new

products that use plastic-free materials with the Paper Cup

Business Development Office and the Product Development

Office. We will also continue to engage in face-to-face sales

in order to be chosen by our customers so that we will

outpace industry standards.

Product Logistics Department

To address the “2024 problem” in logistics, we have introduced a

dynamic management system provided by Hacobu, Inc. at each

of our mills to manage truck drivers’ wait time. This approach has

reduced their wait time substantially; currently, across all mills, the

wait time could be minimized within two hours for more than 95%

of drivers. Going forward, we will conduct monthly inspections and

continue support to maintain this level of efficiency.

As part of our strategic business alliance with Daio Paper

Corporation, we have launched three regional groups for the

East Japan area, the Central and Kansai area, and the West

Japan area, and each group has commenced its activities. We

will calculate the benefits this approach brings over the threeyear

period from FY2024 and realize the effects of the alliance,

such as reducing costs and enhancing transportation efficiency.

CLOSE UP: Reducing the environmental impact of transportation

The Group is promoting a modal shift away from trucking, which has a higher

environmental impact, to more environmentally friendly transportations such

as railways. This helps us lower CO2 emissions in the transport of raw materials

and products. As a result of this effort, we can reduce CO2 emitted during

transportation by around 80–90%.

In addition to using railways, the Group aims to improve transportation efficiency

by employing its own 20ft containers specifically for roll products and by building

a dedicated railway line within the Niigata Mill. By strengthening rail container

transportation, we will accelerate the modal shift and reduce CO2 emissions further.

Rail transport using a dedicated line in the

Niigata Mill