Overseas Business

FY2023 in review

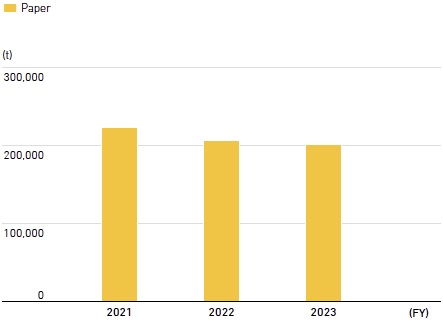

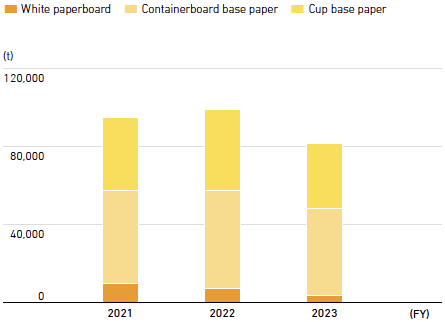

In FY2023, our export volume reached approximately 280,000 tons, earning us the top share of the Japanese market in the printing and communication paper segment. Our main product, coated paper, benefited from stable maritime logistics around the world and steady product supply as the COVID-19 pandemic eased, and we maintained high sales prices. In high-quality paper, the sales focus shifted to processed base paper applications and performed well on both the price and quantity fronts. Additionally, in FY2023, the exchange rate helped us to achieve high profit margins. On the other hand, in the containerboard (corrugating medium) business we faced a challenging environment due to the overall worsening of the Asian market caused by lower Chinese exports. To overcome this situation, we proactively pursued new product development, including introducing lightweight grade and the development of recycled kraft paper. In paper cup base paper, we shifted our focus to Taiwan and successfully increased sales volume by 41% year on year, securing a new market.

■ Export volume

Future strategy for the Global Trading Division

We interact directly with around 50% of our overseas

customers, evincing our focus on strengthening relationships

with loyal customers. Although we face the prospect of

falling domestic demand, we will leverage the production

scale of our mills, the strategic location of our port facilities,

and our accumulated technological expertise to utilize the

unique competitive strengths of each mill. Our priority is to

pursue a marketing strategy that prioritizes stable supply.

Furthermore, we will strive for continuous increases in

exports and contribute to maintaining high operation rates.

Our product development capabilities have earned plaudits from overseas customers, and we are experiencing rising

demand for products that are resilient to changing market

conditions, such as paper cup base paper and recycled kraft

paper for processing and packaging purposes. We are shifting

our focus toward developing high-margin products. In terms

of logistics, taking into account the “2024 logistic challenge,”

we plan to increase shipments from the Niigata East Port

and implement measures to expand the quantity of products

bundled within our Niigata and Kishu mills, with the aim of

lowering logistics costs.

Alberta-Pacific Forest Industries Inc. (Al-Pac)

Status of initiatives in FY2023

In the pulp business, in FY2023 the logistics issues that caused

problems in the previous year improved significantly, and an ample

supply of freight cars were available to ship products. As a result, the

sales volume was up year on year. However, pulp prices continued to

decline from the beginning of the year, and although they rose in the

latter half, pulp sales fell significantly compared to the previous year.

In the power sales business, electricity demand remained weak due

to relatively mild weather compared to the previous year, resulting in

a decrease in electricity sales volume.

Future business strategy

To achieve stable pulp production and improve cost competitiveness, we will continue to invest in the conversion to the highly efficient mill, increase pulp yield from logs, improve energy costs, and optimize processes to reduce chemical usage. Additionally, we are investing to expand our power sales business by enhancing steam turbine condensation capacity to increase power generation, with plans to start operation in the fall of 2024. Furthermore, as a new initiative to reduce greenhouse gas emissions, we are actively considering a carbon capture and storage (CCS) project to separate and recover CO2 derived from biomass fuel emitted during Al-Pac’s pulp production process, store it in appropriate nearby locations, and generate negative carbon credits.

Bernard Dumas S.A.S.

Status of initiatives in FY2023

Amid strong demand for automotive and industrial products, we worked to ensure the stable raw material procurement and product sales, resulting in year-on-year increases in sales volumes and sales.

Future business strategy

The European AGM battery separator market has entered a stable period. However, with the increasing adoption of AGM batteries and the expanding demand for replacements, we will strive to maintain and expand our market share in Europe, as well as aim to expand sales outside of Europe.

Shanghai Toh Tech Co., Ltd.

Status of initiatives in FY2023

A V-shaped economic recovery had been expected after the Chinese government ended its zero-COVID policy at the end of 2022. However, a sluggish real estate market and other factors have resulted in a slow recovery.

Future business strategy

Shanghai Toh Tech worked to expand its customer base in response to the changing business environment mentioned above, and has had some success. Going forward, we anticipate that investments in communication infrastructure for AI servers and data centers will become more vigorous, and we will continue working to capture growth opportunities in this field.

Hokuetsu Corporation Ho Chi Minh City Representative Office

As part of our overseas strategy, we opened a representative office in Ho Chi Minh City, Vietnam, in December 2019. The office is responsible for tasks such as sourcing chips and conducting market research and gathering information on paper products in Vietnam. The office has grown to become an essential base for our overseas strategy. Through this office, we will continue to strengthen direct transactions with overseas suppliers and users.